Actuaries Institute

The Actuaries Institute is the professional body representing the actuarial profession in Australia with a heritage dating back to 1897.

Joining the Actuaries Institute means joining a highly regarded profession whose members are in high demand and are well-rewarded for their skills. Actuaries pride themselves on their analytical and problem-solving skills and their ability to lead in all industries and sectors. We raise the standing of actuaries by providing rigorous standards and integrity that set our profession apart. Through the examination of ideas, the provision of quality education and the connection of people across all practice areas and industries, we help actuaries build successful careers as crucial critical thinkers and data-driven objective advisers.

Our Vision

That wherever there is uncertainty of future financial outcomes, actuaries are sought after for their valued advice and authoritative comment.

Our Mission

To inspire, guide and support actuaries to help business and society be more resilient to future uncertain events.

This is achieved by providing education, standards, representation, thought leadership and a professional community.

Actuarial Career

What is an Actuary?

Actuaries evaluate risk and opportunity – applying mathematical, statistical, economic and financial analyses to a wide range of business problems.

Insurance, superannuation, wealth management, investments, health financing and banking, are the more readily recognised fields in which actuaries work, but we also work in new, high-growth fields, such as data analytics, energy resources and the environment. Many actuaries also hold executive positions in the operational management of financial institutions. However your actuarial career may look, skills in data analysis and management, risk management and data-based decision-making are vital in many industries.

HOW TO BECOME AN ACTUARY

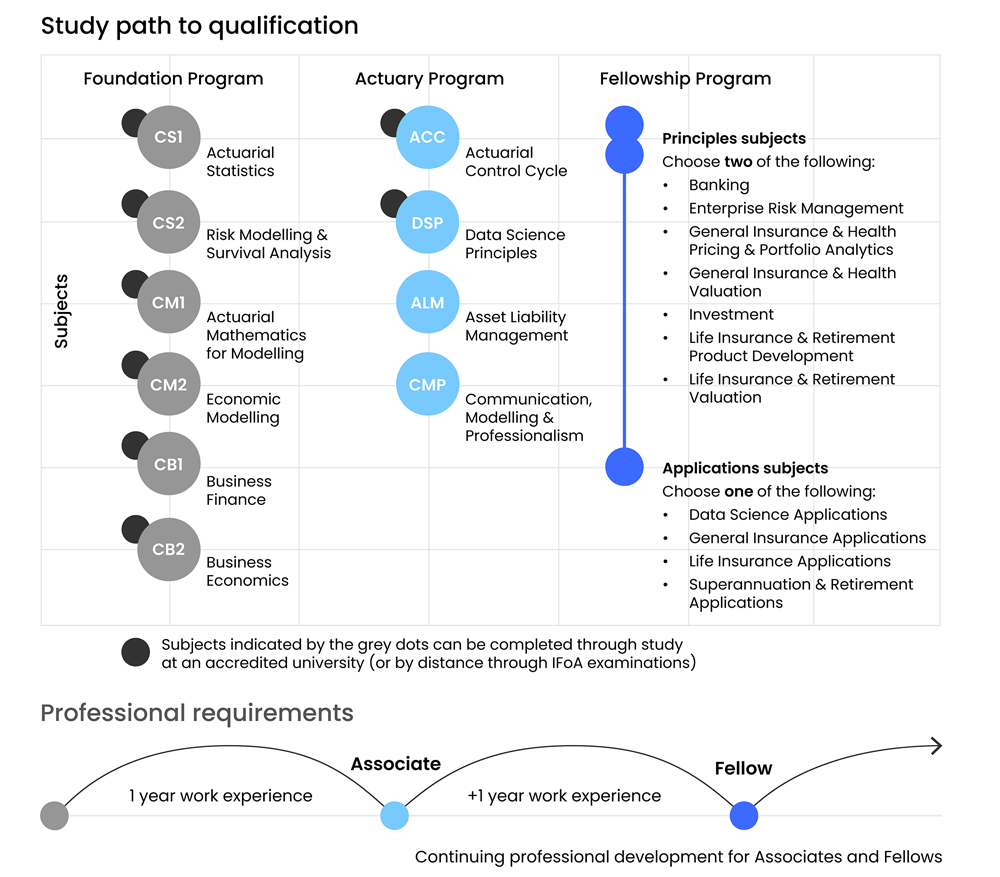

The actuarial education program in Australia is made up of three parts:

The Foundation Program - the first stage in the actuarial qualification pathway, focused on Actuarial Statistics, Actuarial Mathematics and Business, Finance and Economics.

The Actuary Program – complete these four subjects and you will be granted the title of AIAA (Associate of the Institute of Actuaries of Australia).

The Fellowship Program – the Fellowship Program adds depth and specialisation to your professional education. Successful completion of the Fellowship Program will mean you are fully qualified as an actuary and earn the title of FIAA (Fellow of the Institute of Actuaries of Australia).

Completion of programs and actuarial qualifications are generally required for actuarial positions in firms but are generally not required for internships, graduate programs or roles in other fields. Policy and requirements differ depending on role and firm.

Provided criteria are met, completion of Monash units can satisfy the requirements for the Foundation Program and part of the requirements for the Actuary Program. For more information visit exemptions.

You will study the remaining programs and modules with the Institute. For more information visit education program.

YOUR PATH TO QUALIFICATION

Exemptions can be obtained for all modules in Foundation Program as part of the Monash undergraduate Actuarial course.

Exemptions can be obtained for Actuarial Control Cycle and Data Analytics Principles in Actuary Program as part of the Monash Honours or Masters course.

While working, some firms may also offer study leave or reimbursement for fees towards qualifications.

Actuaries Digital

Actuaries Digital is an online blog and publication by the Actuaries Institute Editorial Team.

At Actuaries Digital our purpose is to provide a platform for actuaries to showcase their diverse talent and thought leadership to the profession and to those in the industries served by actuaries.

It is our ambitious vision to be the first port of call for industry news, commentary, featured content and developments that affect the profession. View our Editorial Policy.